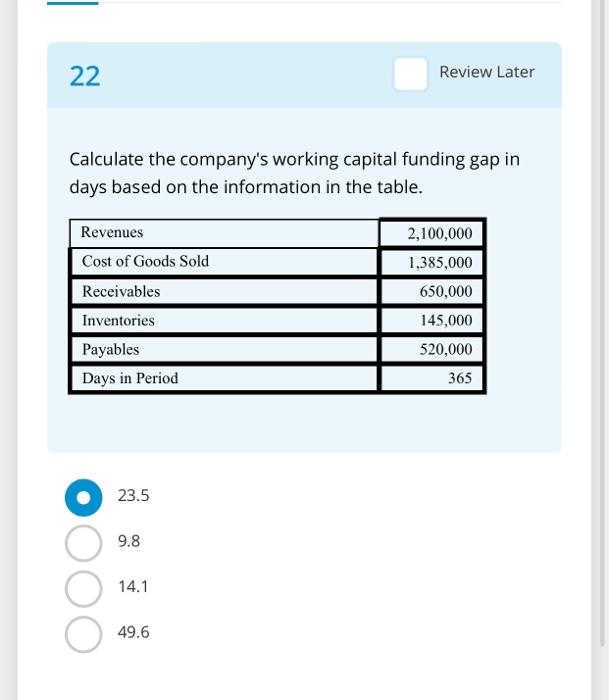

working capital funding gap

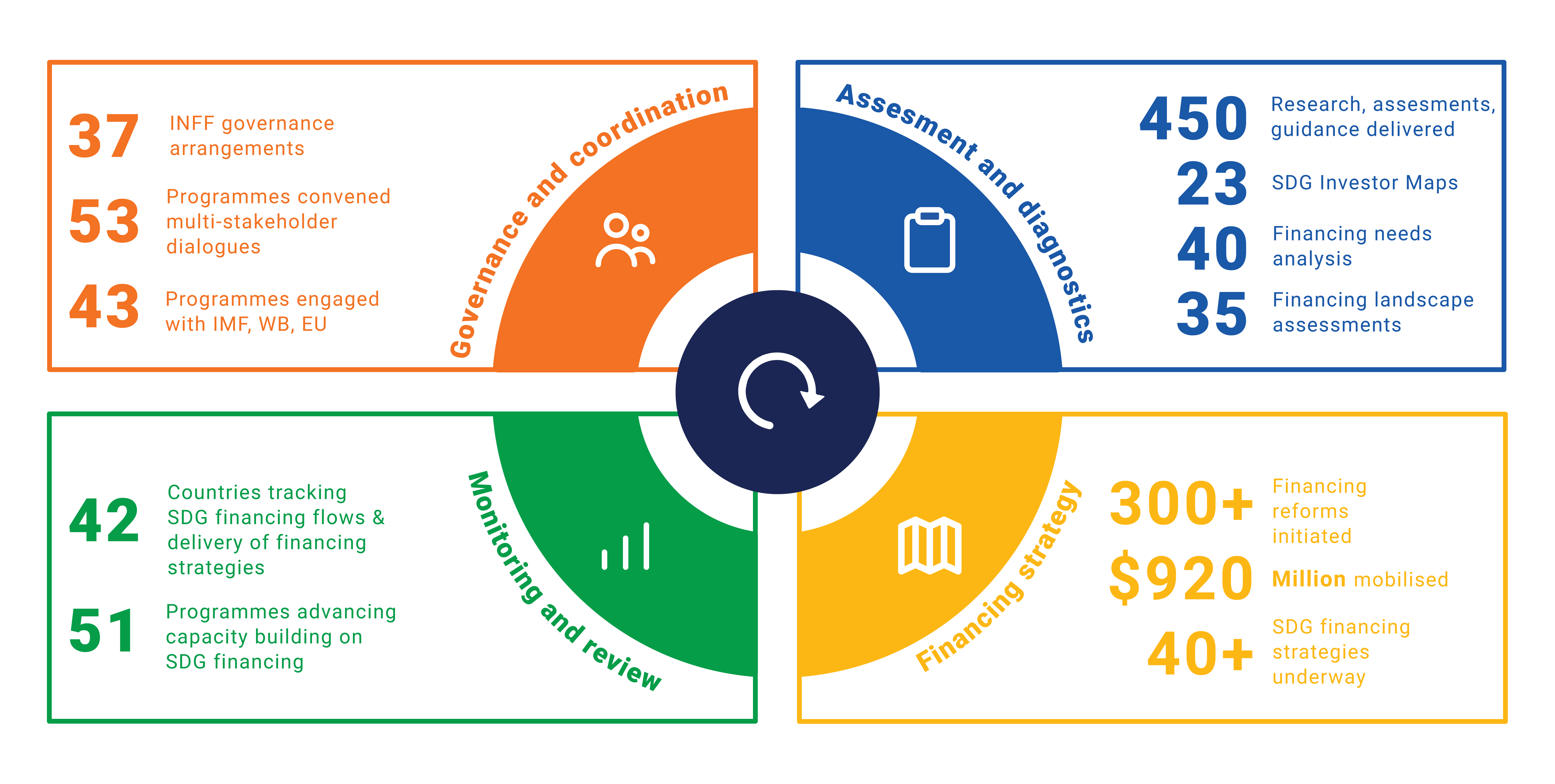

The action Company should take to reduce its working capital funding gap by Increasing inventory levels. In plain terms the working capital deficit is the difference between total liquid assets and total equity other than bank liabilities.

Secret Tips To Improve Your Working Capital Management Quantzig

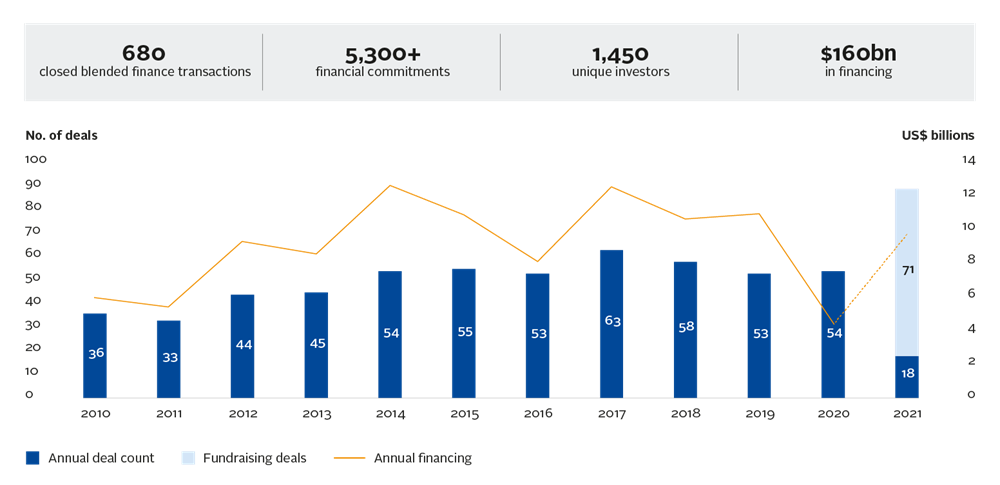

Working Capital Cycle Sample Calculation.

. Raise the price of the products to increase. What actions could a company take to reduce its working capital funding gap. It is a planned process because it means you have thought about all these possible problems and made plans for them.

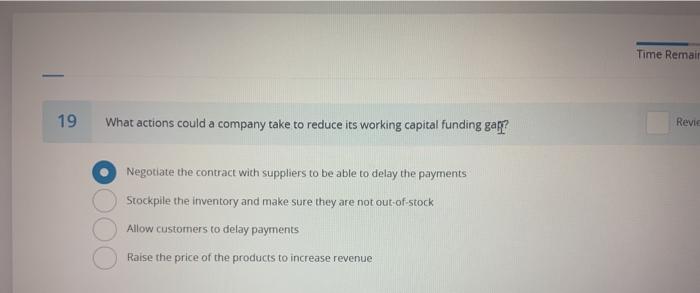

Negotiate the contract with suppliers to be able to delay the payments What could be the yield to maturity for. DWC Average working capital 365 Sales revenue where. Working capital can be negative if current liabilities are greater than current assets.

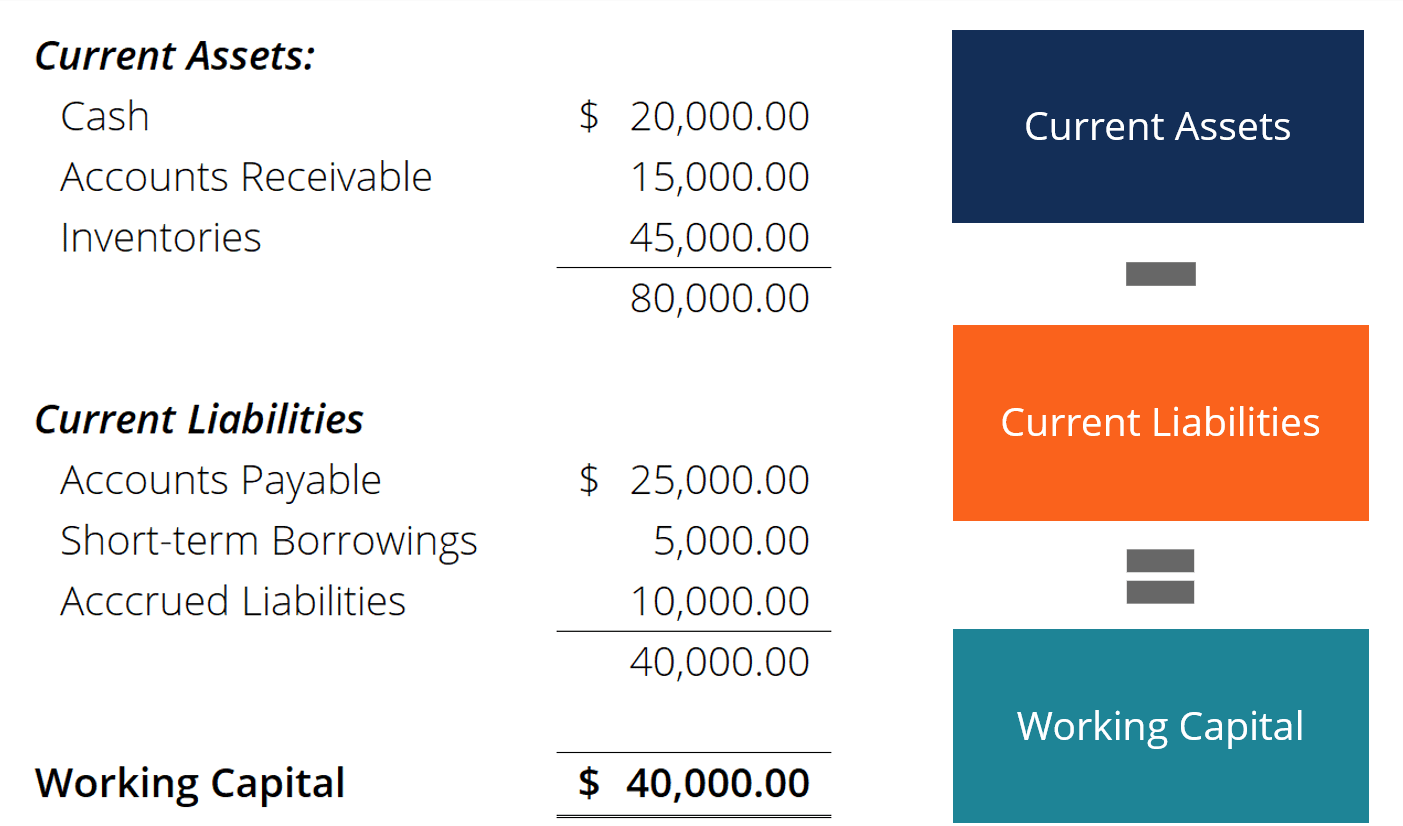

Based on the above steps we can see that the working capital cycle formula is. Working Capital Cycle Formula. Working capital increases because accounts receivable goes up by 50000 and inventory decreases by 41000.

Working Capital Gap. And this is exactly where working capital management comes in. What actions could a company take to reduce its working capital funding gap.

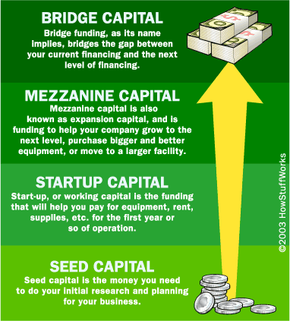

Now that we know. Working capital is the difference between a companys current assets and current liabilities. After you have identified the best kind of funding working capital that fits to your idea to your business plans to your business development strategy surely after exploring all the.

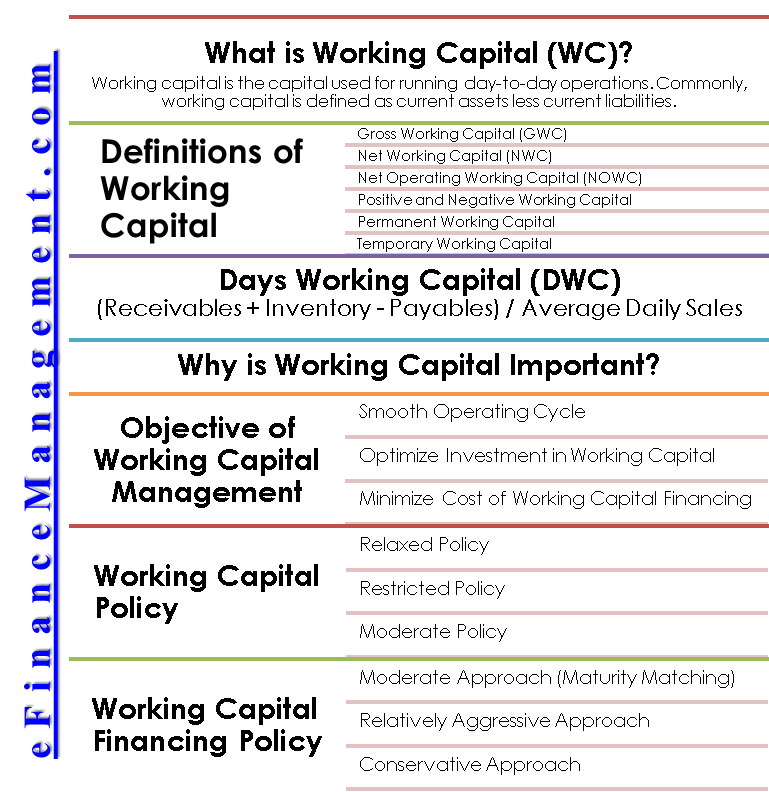

Tighten customer credit terms. Working capital funding gap refers to a gap that exists when the amount of money that is needed to fund ongoing operations or the future development of the business is not currently funded. Delivering new working capital finance models through future technology Advances in technology have permeated every aspect of life.

What actions could a company take to reduce its working capital funding gap. Stockpile the inventory and make sure they are not out-of-stock. It can also be described.

The proportion of the company financed by. Average working capital Working capital averaged for a period of time Sales revenue Income from sales. Theres no change in current liabilities.

The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. Also keep in mind that. The debt to equity ratio indicates.

The debt to equity ratio indicates. A The proportion of the company financed by lenders versus owners B The net worth of the company C The liquidity of the company D A companys. Working capital is the cash used daily cover all of a corporations.

Working Capital Funding Gap Ppt Powerpoint Presentation Portfolio Tips Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Closing The Funding Gap The Case For Esg Incorporation And Sustainability Outcomes In Emerging Markets Discussion Paper Pri

:max_bytes(150000):strip_icc()/final_daysworkingcapital_primary_definition_1011-c4e81209c4b14f52bc9e44c7d28522f4.png)

Days Working Capital Definition Calculation And Example

Research It S Time To Close The Gender And Racial Funding Gap 2022

Working Capital Requirement Formula Plan Projections

Working Capital Formula How To Calculate Working Capital

Working Capital Financing What It Is And How To Get It

Together Smes And Fintech Can Battle Against Cash Crunch By Abhijit Das Medium

Solved Provide The Best Answer For Each Of The Following Chegg Com

Working Capital Cycle Day Ratios Financial Edge

Working Capital Cycle What Is It With Calculation

Working Capital Importance Policy Manage Finance Efm

Working Capital Cycle Definition How To Calculate

How Start Up Capital Works Howstuffworks

Solved Time Remail 19 What Actions Could A Company Take To Chegg Com

Invoice Factoring For Manufacturers Increase Working Capital For Growth And Expansion